FLSA Overtime Regulations and Penalties

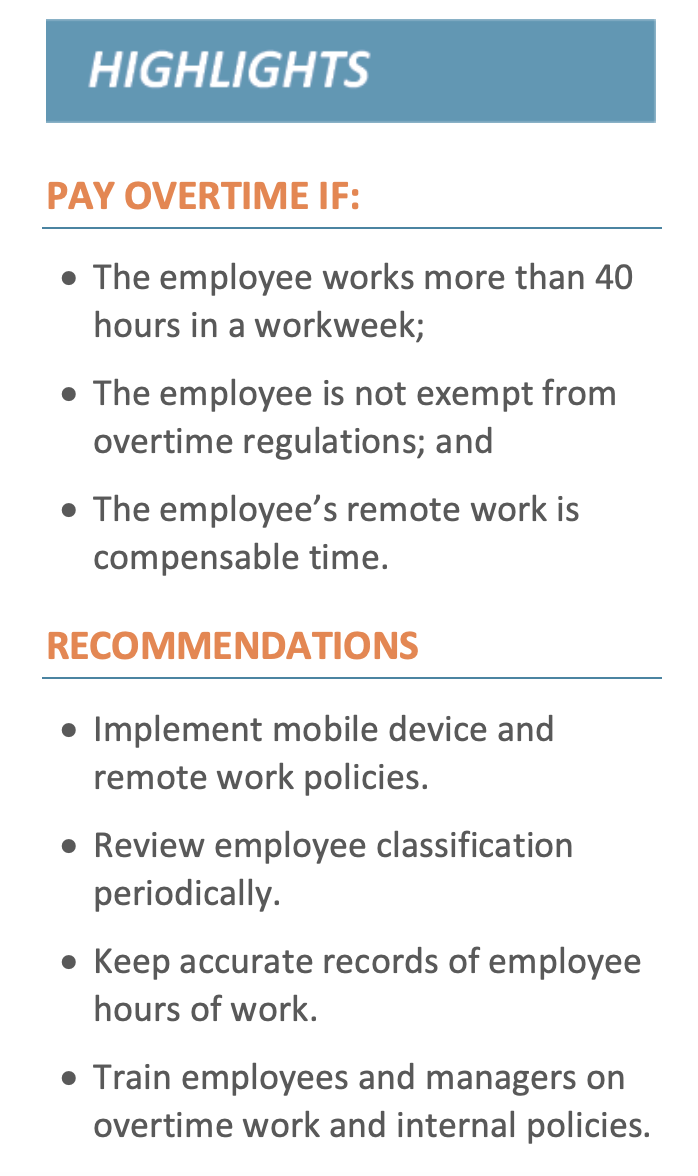

Most employers in the United States are subject to the Fair Labor Standards Act (FLSA). Under the FLSA, there is no limit on the number of hours employees may work in any workweek, but employees must receive one and one-half times their regular wage rate for all hours worked over 40 hours in a workweek. Sanctions for violating FLSA overtime regulations can be severe, and may include fines of up to $10,000, imprisonment for up to six months, civil liability and any other penalty a federal or state court considers appropriate.The main difficulties employers face when determining whether an employee working remotely is entitled to overtime compensation are:- Whether the employee is exempt from overtime regulations; and

- Whether the employee’s remote work is compensable time.

FLSA Exemptions

If an employee falls within an FLSA overtime exemption, then the employer does not need to worry about how many hours the employee spends working remotely. The FLSA provides a number of exemptions to overtime compensation, but the most common exemptions for employees using employer-provided mobile devices are known as the “white collar exemptions.” Contact Marshfield Insurance Agency for more information on FLSA regulations and exemptions.The White Collar Exemptions

The white collar exemptions apply to individuals employed in a bona fide executive, administrative or professional capacity.As a matter of procedure, the FLSA presumes that an employee is not exempt from overtime pay, and it is up to an employer to prove otherwise. To prove that an employee qualifies for the white collar exemption, an employer must show that the employee satisfies the salary basis test, the salary level test and the duties test. If an employee fails to pass one of these tests, the employee is not covered by the white collar exemption.- The salary basis test is used to make sure the employee is paid a predetermined and fixed salary that is not subject to reduction due to variations in the quality or quantity of work.

- The salary level test is used to ensure that the employee meets a minimum specified amount to qualify for the exemption. This salary threshold provides employers with an objective and efficient way to determine whether an employee qualifies for a white collar exemption.

Compensable Work

If an employee does not qualify for an FLSA exemption, the employer must determine whether the employee’s remote activities are considered “work” and are therefore compensable. The U.S. Supreme Court has defined “work” or “employment” as physical or mental exertion that is controlled or required by an employer for the employer’s benefit. The Court has recognized that this description includes the idea that an employer may hire an employee and require him or her to do nothing or to wait for something to happen.An employee working remotely is performing compensable work if he or she is performing a principal activity or if he or she is on duty. If the employee is performing compensable work and is not covered by an FLSA exemption, he or she is entitled to overtime compensation. However, if the amount of overtime compensable work is negligible, the de minimis doctrine will allow an employer to overlook FLSA requirements.Principal Activity

The Portal-to-Portal Act of 1947 (the Act)—a supplement to the FLSA—defines “work” as the employee’s performance of his or her duties (the principal activity for which he or she was hired). This includes any activity in which an employee must participate to perform his or her principal activity.For example, employees working with hazardous materials are considered to be working when they put on or take off protective clothing and equipment. However, the Act also limits the scope of activities related to work, and specifically excludes any time an employee spends in “preliminary or postliminary activities,” such as traveling to or from work.Employees On Duty

The use of mobile devices has blurred the line between the times when an employee is expected to work and when an employee independently and willingly choses to work during his or her time. Allowing employees to work remotely raises considerations of on-call employment, where employees may not be present at the workplace, but are still expected to participate, report or respond to the employer’s requests at a moment’s notice.To decide whether an employee is on duty while working on a mobile device, an employer must determine whether the employee was relieved of all duties at the time of his or her remote work. The degree of interference and control an employer has over an employee’s actions while the employee is working remotely plays a key role in determining whether an employee is on call or has free use of his or her time.De Minimis Doctrine

The U.S. Supreme Court has adopted the de minimis doctrine to deal with negligible amounts of work employees perform when they are off duty. The court reasoned that penalizing negligible violations isunnecessary, and that an employer should not have to worry about compensating an employee for de minimis remote work.To determine whether overtime remote work is de minimis, employers should consider whether:- It would be practical, from an administrative perspective, to record the additional time;

- The aggregate amount of additional remote work is significant; and

- The employee regularly engages in overtime work.

Recommendations for Employers

Employers can take actions to avoid liability for unpaid overtime compensation for employees who work remotely with the assistance of mobile devices. Employers can implement mobile device policies, ensure proper employee classification, keep track of their employees’ remote work time and train personnel on overtime regulation issues.Mobile Device Policies

Employers should review their policies and objectives to determine which employees within their organizations need or should have access to employer-provided mobile devices or remote work options. Limiting remote connectivity to the workplace to employees exempt from overtime regulations reduces the amount of liability that employers may be exposed to.Employers should also adopt policies that:- Require non-exempt employees to obtain authorization from a supervisor to work remotely before the employee is provided with a mobile device or remote access to the employer’s network; and

- Instruct employees on their work-hour requirements, whether they are required or expected to check company email off-the-clock, how fast they are required to respond if an answer is necessary and whether individuals who make a personal decision to contravene this policy will be paid for doing so.

Employee Classification

Employers should review FLSA exemptions carefully and ensure that they classify employees and their exemptions appropriately. When classifying an employee, employers should consider the employee’s salary and job description.As part of this classification, employers should periodically update their employees’ job descriptions and harmonize the descriptions with the employees’ actual responsibilities at the workplace. Updating an employee’s job description may also lead an employer to adjust or update the employee’s exemption status.Keep Accurate Records

The DOL encourages individuals to keep personal records of their work hours, and will compare an employee’s personal records to the employer’s records during a wage and hour investigation. The DOL has made it even easier for individuals to keep track of work hours by making a time-tracking smartphone application publicly available.Because of increased DOL attention to the issue, employers should make an independent and proactive determination of whether employees working remotely are working overtime. Technological advances make it possible for employers to keep track of employee usage of employer-provided mobile devices. Employers should consider the costs and effort necessary to monitor remote work hours when developing internal policies to regulate employee connectivity.Training

After adopting remote work and connectivity policies and procedures, employers should educate their employees on these policies and on their specific work responsibilities. Employers should also take time during training sessions to set clear expectations for employee overtime work.In addition, employers should spend additional time training their managers and supervisors on overtime issues created by remote connectivity. Managers and supervisors are primarily responsible for monitoring and ensuring employee compliance with overtime policies, and should be able to recognize when any particular situation may expose the employer to FLSA liability.This Compliance Overview is not intended to be exhaustive nor should any discussion or opinions be construed as legal advice. Readers should contact legal counsel for legal advice.

© 2016 Zywave, Inc. All rights reserved. 9/16