Protecting yourself in the event that your data is stolen through Cyber Liability and Data Breach coverage, with help from Marshfield Insurance. This type of insurance protects a business’s customers (third party) and the business itself (first party) from data breaches/hackers/scammers.

“It helps reimburse monetary loss and fines associated with breaches to both the business and their customers,” explained Nick Arnoldy, owner/broker.

Even if you don’t have a computer-related system, Arnoldy recommends that everyone have data breach coverage – a data breach doesn’t require technology.

“It covers information that could be copied on paper financial statements, as well as stolen smartphones and laptops,” he said.

Furthermore, most businesses retain employee records that contain confidential employee data – SS#, dates of birth, checking and routing #s for deposit. Most also accept payments by check, which have customer’s account numbers, routing numbers on the physical check, and debit or credit card transactions.

Card readers and online vendors can sometimes provide a false sense of security by promoting their systems to be secure and indemnify their clients (area businesses) while hosting sensitive customer information, according to Arnoldy.

“The card reader vendors and online payment vendors of small and large businesses can not control or guarantee data transmitted via the internet to be safe,” he explained. “In other words, payment vendors have securities in place and sometimes indemnify their clients while the data is stored with them but the internet highway it travels on is vulnerable to interception (info in transmission cannot be protected by the payment vendor, they do not own all transmission lines or airwaves).”

The best way to protect data is updating passwords regularly, ensuring passwords aren’t too simplistic, and password protecting all mobile devices and laptops used for work. Also, be careful of phishing schemes, and purchase data breach coverage.

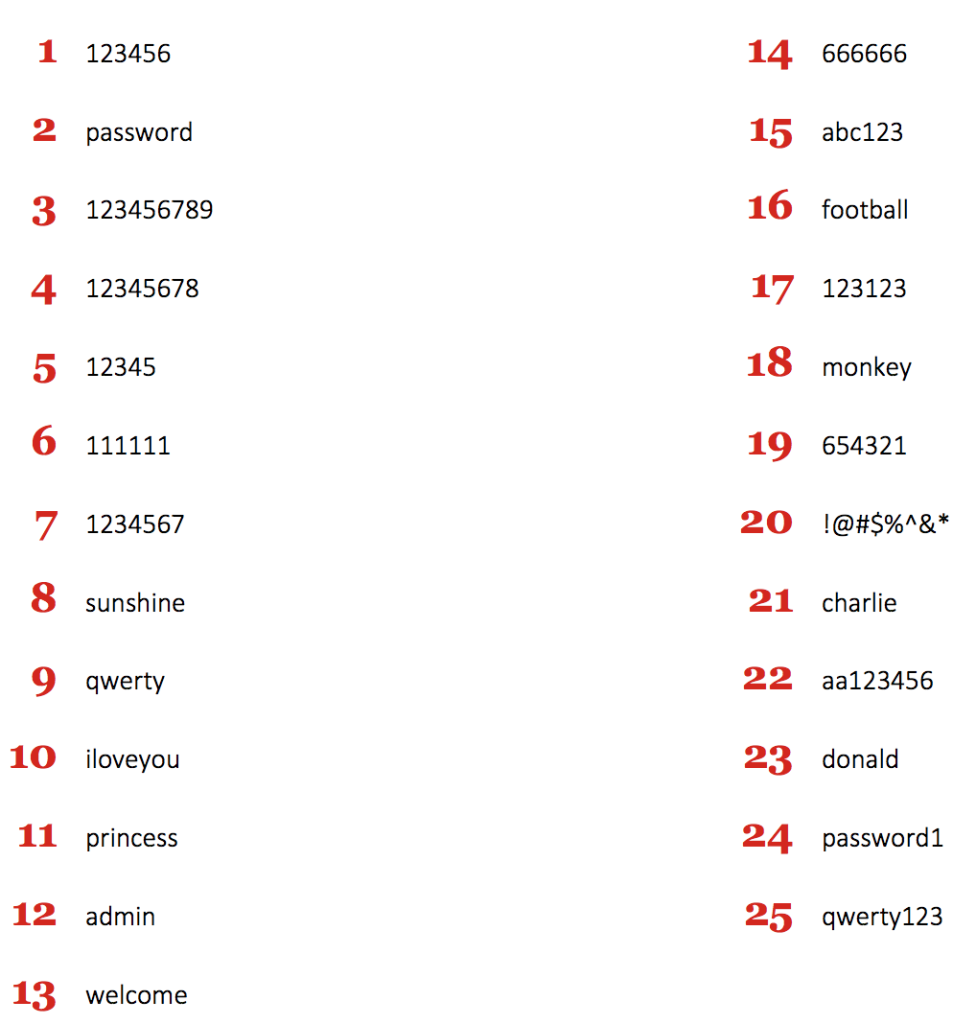

How clever is your password?

If it’s on the list below, your password is just as easily stolen as it is remembered! Protect yourself by making sure you’re not using one of the top 25 most commonly stolen passwords of 2018, as determined by IT security firm SplashData.

To create a more secure password, make sure you are not relying only on numbers, and try to avoid simple keyboard patterns. You may also want to avoid easy-to-find information such as birthdays, favorite sports teams and addresses. Attempt to create a password that is eight or more characters long, and avoid using the same password for multiple access points.